On a more regular basis, our clients have been asking us to help them consider the pros and cons of directly purchasing real estate to rent out as an alternative investment for their capital. At Parkside, we look at real estate as we would any other potential investment: objectively and dispassionately. We consider the capital invested, opportunity for growth in value both independently and relative to other asset classes, leverage employed, liquidity, and ultimately the value of the cash flows projected to be earned over a period of time.

We refrain here from making a prediction of real estate valuations. However, for those who are trying to do so and are data inclined, we suggest you check out the Zillow Research website if you haven’t already.

A Financial Model for Calculating the Expected Return on Rental Real Estate Investment

To aid in our real estate analysis, our Tax Planning and Financial Planning teams collaborated to produce a user-friendly Excel model that clients could reference, either working with us or on their own, as they consider properties.

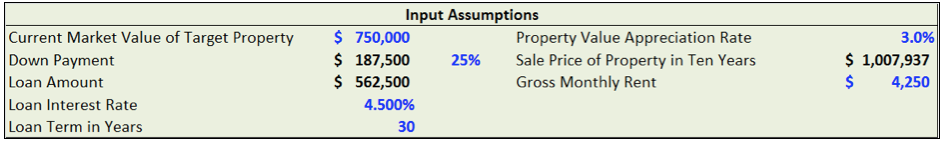

The model requires clients to input the property basics, such as market value of the property, the structure of the anticipated financing, the monthly rental income, and the expected annual property value appreciation:

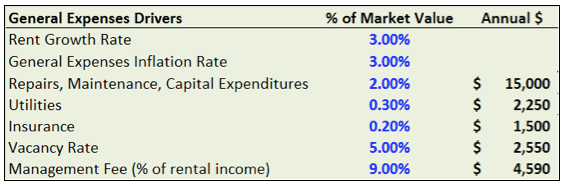

The model also asks for detailed assumptions on the ongoing general expenses of the property:

Additional inputs include property taxes, income tax rates, transaction costs, and depreciation factors. These data drive the financial model to calculate ten years of projected cash flows from the property, including the net cash received from the eventual future sale of the property. The projected ten years of cash flows provide the basis for calculating an expected Internal Rate of Return (IRR) on the equity invested. The IRR is a percentage that measures the annualized return over the period on the capital that was invested (the equity/down payment capital) based on the cash flows received. The IRR can also be viewed as a “hurdle” rate for considering other competing investment opportunities using similar leverage.

The Effects of Using Leverage in Investing in Rental Real Estate

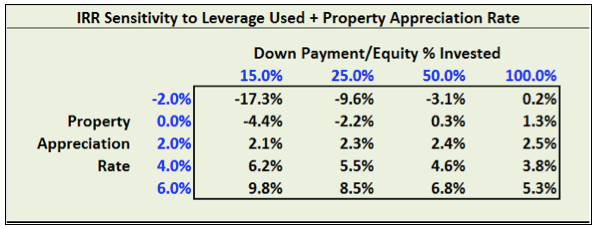

One incremental part of the model we want to highlight is an IRR sensitivity table. The table exhibits the effects of using leverage in investing in real estate, or frankly, in any investment asset class. There are two data sets, scaled at different levels to show their impact together on the IRR calculated. One row is the %-equity (down payment) invested—a lower percentage of equity implies you are using a higher percentage of debt. The second row is the assumed annual appreciation rate of the property’s value. What one can see is that the more debt that is used, the greater the potential for gain or loss in the investment, depending on the property appreciation (or depreciation!) rate.

It is important for clients to consider the leverage aspect of a direct real estate investment—the use of leverage amplifies the magnitude of potential returns, both positive and negative, and therefore increases the risk of the investment. Adding to the risk is high transaction costs and the limited ability to trade in and out of the investment with ease.

Our model addresses the effect of income taxes; however, it does not address the new 20% pass-through deduction for Schedule E rental income. This deduction is complex—it depends on whether the rental income received comes from a “real-estate business,” imposes limitations due to higher income earner levels, and has limits relating to basis in the investment. We suggest you contact us to discuss these tax planning aspects in more detail.

Please let us know if you’d like us to walk you through the model, or if there is any way we could be helpful as you consider investing in residential rental real estate.