“How much money do I need to retire?”

Finding an answer to this question is one of the cornerstones of the financial planning profession. From simple online calculators for the do-it-yourselfer, to sophisticated software projections used by financial planning professionals, there is no shortage of tools for calculating how much you should save to ensure your golden years will be golden. However, like most technology tools available today, the potential benefit of the output is highly dependent on the accuracy of the input.

Assets, liabilities, income, and expenses are the core elements of any retirement projection. The values of assets, liabilities, and income are easily obtained—you already know the value of your invested assets, how much income you earn, the balance of your mortgage, etc. But how much are you spending? If you’re like most people, you’re probably having an allergic reaction to that question right now, and the recent 400% increase in the cost of an EpiPen won’t help the situation.

The importance of knowing how much you are spending cannot be overstated. Cash flow during working years will determine how large your nest egg is at retirement. Cash flow during retirement will determine how long that nest egg will last. If expenses are understated in a retirement projection, the estimated amount of savings needed at retirement will also be understated. The unfortunate and painful realization for those who haven’t saved enough for retirement is that they will have to continue working long past their anticipated retirement date, which usually accompanies a drastic change in lifestyle to reduce spending.

We know it’s hard to develop and maintain a budget to track your current expenses. This is one of the essential areas that we assist our clients with and one where we can provide great value. An even more challenging task is projecting what spending will look like during retirement. People often assume, for example, that because their mortgage will eventually be paid off, that their home-related spending will go down significantly in retirement. Paying off mortgage debt does reduce home-related expenses, however, they continue to be the largest portion of retirees’ overall spending. What other spending surprises are waiting for you in retirement? Recent data from J.P. Morgan suggests that not all of them are bad.

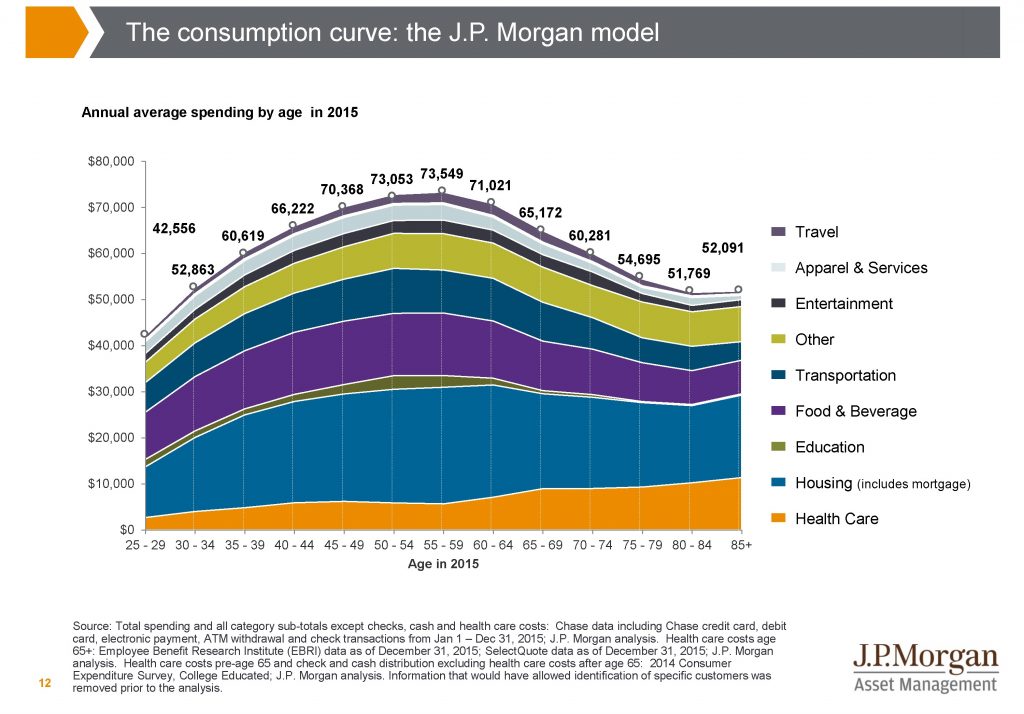

As seen in the chart below, one of J.P. Morgan’s key findings in a webcast presented to financial advisors is that spending typically peaks between ages 50 to 60, when income is also at its highest.

This information is helpful for gathering a “big picture” perspective of how your spending might look over time, but the obvious limitation is that it doesn’t account for your specific situation. Additionally, the rate at which each of these spending categories increases over time is not identical. For example, this same study from J.P. Morgan cited that from 1982 to 2015, food and beverages had an average inflation rate of 2.9% per year, whereas the inflation rate for healthcare costs was 5%. This difference in price inflation disproportionately affects retirees, since they tend to spend more on categories that have higher inflation rates (such as healthcare) than they do on categories with lower inflation rates (such as apparel and entertainment).

Other important elements of retirement spending include the type of assets you are spending from (taxable vs. non-taxable vs. tax-deferred), the timing of your distributions from those assets, and the overall rate at which you withdraw from your retirement assets.

Tracking your spending across broad categories now, using a spreadsheet, a free online service such as Mint or Personal Capital, or even a paid solution such as Quicken, is crucial for developing a realistic budget. And a realistic budget is a prerequisite to developing an accurate retirement projection and financial plan.

Besides tracking the categories of your spending, it is helpful to have all income directly deposited into a managed investment account with an automatic monthly transfer into your checking account for living expenses. This makes savings the default destination for your income and is an easy way to live on a budget and confirm how much you are spending overall.

Parkside Advisors offers clients a comprehensive financial planning solution that includes planning and advice centered on the following key areas: cash flow, investments, taxes, insurance, estate, retirement, and education funding. We look at each client’s situation on an individual basis and develop meaningful solutions that clients can implement.

To learn more about how we can help you plan for your current financial situation and for retirement, please connect with us. For more personal finance insights, continue to follow our blog and follow us on Twitter and LinkedIn.